Quote from P.G. ANNUAL COMPREHENSIVE FINANCIAL REPORT For the Year Ending June 30, 2022

- “As of the end of the current fiscal year, the City’s governmental funds reported a combined ending fund balance of $29,836,008. This is a substantial increase of 48.52% from the prior year, of $20,088,731. Substantial increases were from monies received from sales tax, permit fees, and impact fees, as well as $6,500,000 in bonds issued for road reconstruction projects. $6,266,842 (21%) is available for spending at the government’s discretion (unassigned fund balance). The City’s sales and property tax base continues to grow with the increased commercial projects being completed.” (Download report and see page 17)

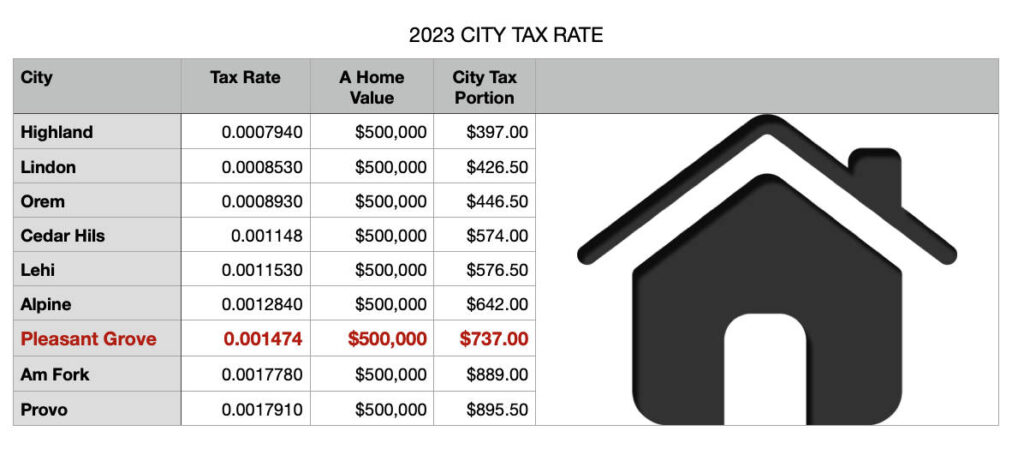

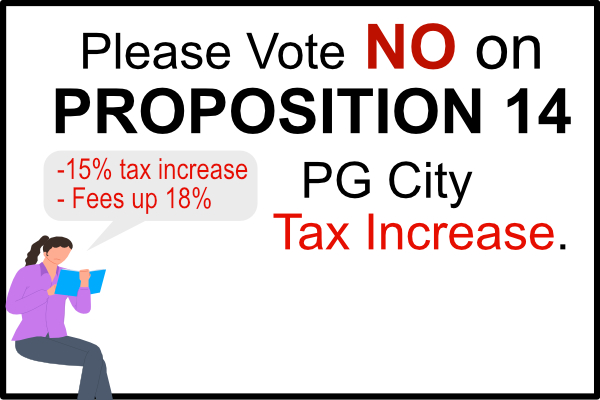

Our Comments: With a 48.52% increase in money from the previous year $29,836,008 over 2021’s $20,088,731) What did the city council do with the money? They also issued a $6,5000,000 Bonds for roads but they say if the 15% tax increase doesn’t pass roads, police and fire will take a hit. Not true! Will the City Council take some of the road bond money or some of the discretionary fee to pay down the TOTAL bond cost P+I of $58,022,123? The bond is being used for non-essential items the City Councils wants, not what the people need. See full payment schedule here.

Why is the PG City Council not prioritizing the Police and Fire departments by fully funding them first out of the budget? As stated above, the city had a 48.52% increase in funds, yet the city says without a tax increase the fire and police departments will go under funded. It sounds like the City is de-funding these departments to a degree and placing more importance on a $36 million park and cemetery expansion over our safety. Maybe the City just wants to use fear and uncertainty for our safety to manipulate the citizens of PG into voting for the tax increase to fund their park priority. The City Council should fund our police and fire departments first, not as an afterthought and only if there’s a tax increase.

– How taxation, without voter representation at the ballot is not representing the will of the people – READ THE ARTICLE

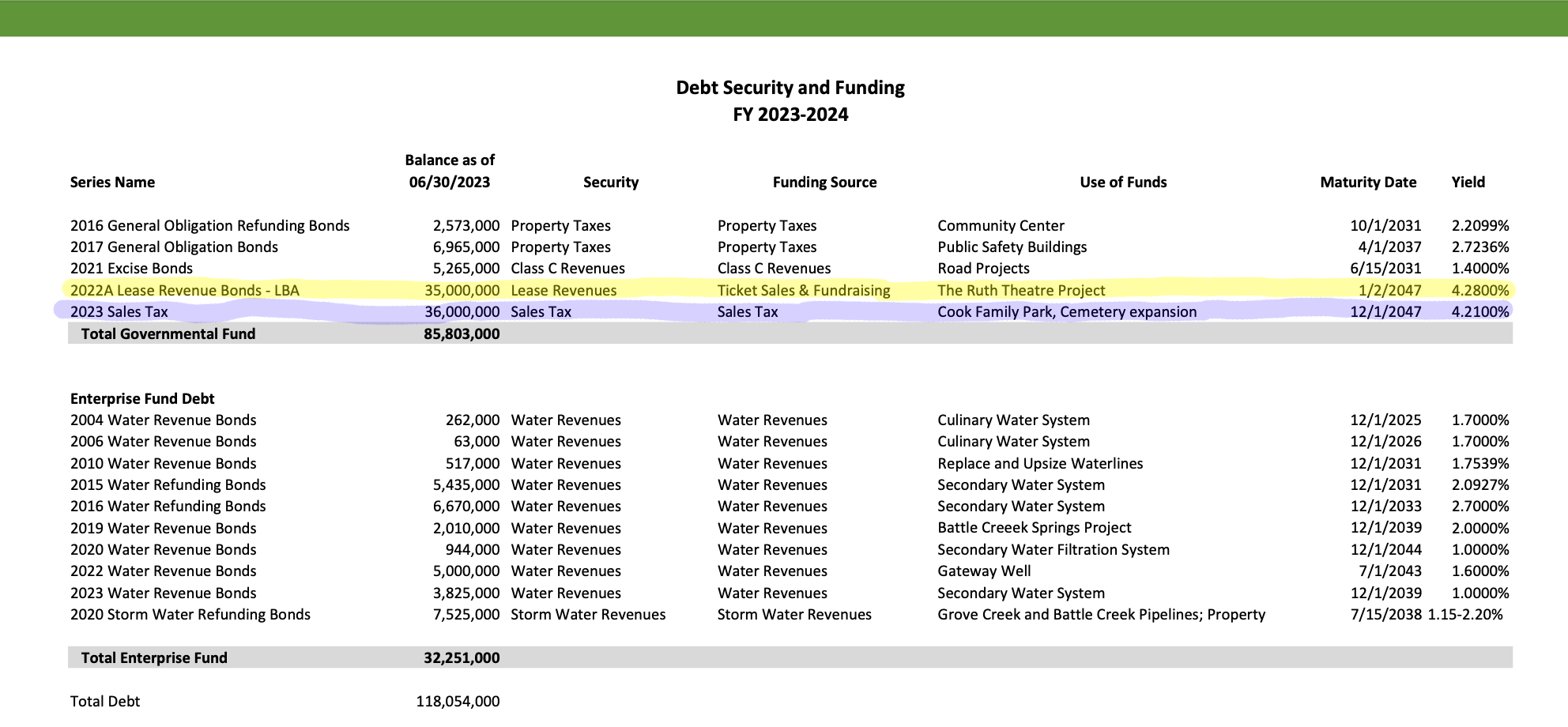

Below is a portion from the 2024 adopted PG budget. page 110 – Download full report here.

Do you see anything strange in the highlighted portion below? What were we told about the total cost of the Cook Family Park? Citizens were told that the park was a cost of $15,000,000. $5 million would come from the Cook Family over time to pay off their portion of the bond, $5 million from what the city had on hand and $5 million from the tax increase. What does this official document say the total cost of the park is and how is the bond being secured? In this document it says (see below) sales tax but what citizens were told is that it was a bond and the property tax increase. It is easier for people to buy into a tax increase if you put police, fireman parks, and library. You get the point. The city says one thing but does another. The park is not costing $15,000,000 but closer to $35 to $50 million when you include interest payments on the bond, and other costs not mentioned by the city. See above – How much will the 36 Million dollar bond cost you?

There should be no taxation without representation from citizens’ voting on large expenditures. We all voted on the public safety center that eventually passed as an approximate $10 million bond. The $36 million park/cemetary bond is more than 3 times that size yet the City chose to not let the people decide. Now, we have our choice thanks to the signature gathering effort and the Referendum. Only five people, in a city of 37,630 should not be the only ones deciding on these large expenditures. That is a huge problem. Especially when you consider the city does not have anyone on staff with advanced financial accreditations. (see Fraud Risk Report) line 3 and line 4 is interesting also if you are concerned about ethical behavior.

Important Information shorts

This is some of the top news in the City

36M

Bond

Did you know PG bonded for $36 Million? The total payback cost is $58,022,123 after 14+ years. This money is being spent on nonessentials. Guess who is liable for the debt? The residents of P.G.! Did you give the city permission through a vote to take your money out of your pocket? NO, because the City Council didn’t want you to vote on it. Last year your taxes went up 15% and they want another 15% this year. Payment schedule

Increase in Utilities

18%

Just in the last year.

Did you know any extra money left over from the utility fees is rolled into the general fund and can be used for anything the city council wants to spend it on without you knowing.

15M?

Park

The city council wants a 15 million dollar park that they say will be funded by a 5M donation, 5M of existing funds and 5M from the bond, that’s 15 million. Then why did they get a 36M bond? The park will cost way more than $15,000,000 by the time they include all the water retention and storm drains, etc. P.G. has never come in at or under budget on any project. They estimate low to get citizen buy in and then over spend.

We are a group of Pleasant Grove citizens that love the area and believe the city council and mayor are not being totally transparent with the citizens. Large expenditures such as a $36 million bond and a $30 million to the Hale theater should be voted on by the people, not decided by 5 city council members. P.G. is your city and you should have a voice with your VOTE.

In early 2023, the Pleasant Grove city council voted on a $36 million bond (like a loan) without hardly anyone knowing about it. It wasn’t posted in the city newsletter or the city website. Now they just talk about a tax increase going to a $15 million park. The reality is the bond is for $36 million. The city council told us the city had 5 million on hand, 5 million was from the Cook family and 5 million they needed to borrow. It sounds like the $36 million bond should have been $5 million. What is the other $31 million being spent on. All you hear is park, police and fire. Did you also know that the city bonded for another 30 million dollars to fund the Hale Theater? We are not opposed to the park, or adding police and firefighter staff if really needed.

We are opposed to a rogue city council spending money without enough citizen input or allowing the citizens to vote on it. At the Truth in Taxation Hearing on August 1st, many good ideas were proposed for the park that would save PG residents millions of dollars. Several people suggested a phased in approach. Others suggested taking some of the 40 acres of land and selling lots for nice, single-family home that surrounds the park like Orem has. Overall, we feel the city council is trying to cut out the citizens even though in a city report there is an org chart showing the citizens at the top of the organization (Click here to see chart)

Debt and Documents to Read

Here are important documents like notes from meets, budgets, etc.

36 Million Dollar Bond in 2023

Pleasant Grove City Council wants 15% tax increase to fund the bond. Will cost residents close to $58 million.

Title

Text

Pleasant Grove funds Hale Theater

PG bonds for $30 million in Nov. 2022 to loan money to Hale theater. PG citizens used as collateral for bond.

Title

Text

Title

text

Title

Text

You need to know

Why are we so upset about what is going on InsidePG

Pleasant Grove is a great location and we want great leadership. Unfortunately the city council and Mayor have been making some bad financial decisions. We feel it is time for change. Let’s not keep voting in the same people. Let’s Vote in all new City Council members.

- We the people want to VOTE on Bonds.

- We the people want to know how the city is spending tax dollars.

- We the people want leaders in Council positions not spenders.

- We the people want full transparance in all PG city activities without having to pay hundreds of dollars on GRAMA requests.

- We the people wish we could trust the City Council to make good choices in the best interest of all Pleasant Grove citizens.

DoTerra

Largest Employer

497K

Median Home price

37,630

PG Population in 2022

LD55

Legislative District

Explore More News – (Still under Construction)

This is your awesome description

Utah’s Median Multiple Affordability Rating, 2000-2022

As home prices, mortgage rates and monthly rents have all climbed, the trends have conspired to leave most homeowners and nine of 10 renters in Utah unable to afford what is currently available on the market, the think tank’s sobering study finds. (Full Article)

Utah among most expensive states for homebuyers

Utah houses can set you back over half a million dollars, or $508,375, to be more precise. (Full Article)

Utah’s housing reaches record high prices creating concern for future buyers

Utah’s housing market has become incredibly expensive and it is creating issues for home buyers now and in the future. (Full Article)